The Economics of Scuba Diving Equipment Industry in the Phase of Post-Pandemic

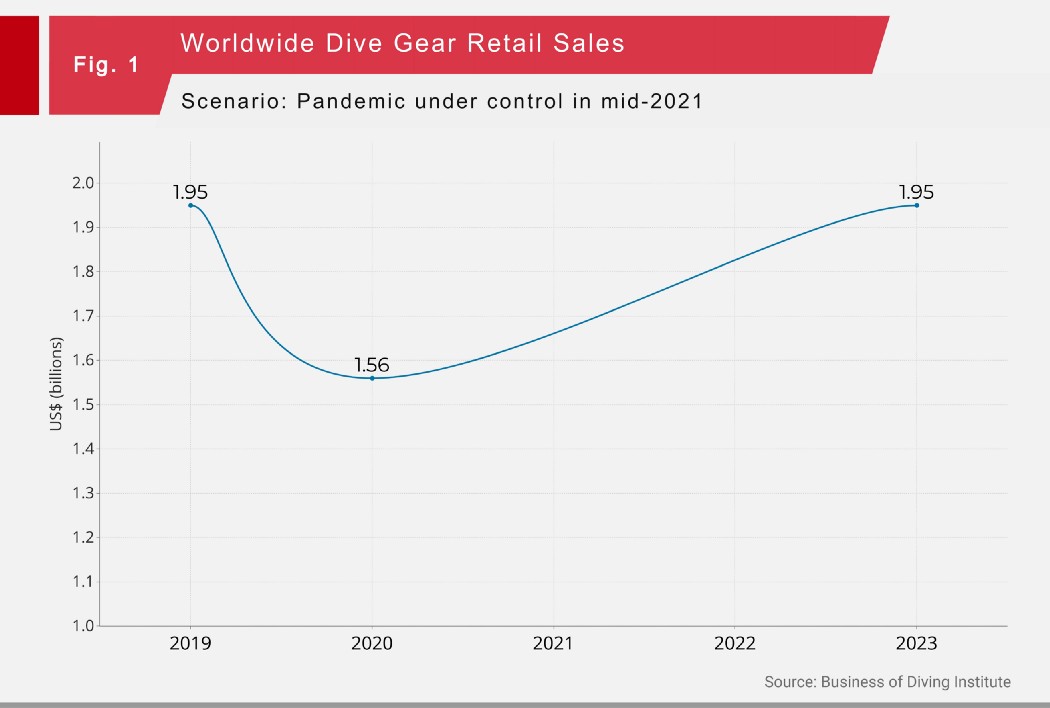

In 2019, the global recreational scuba diving equipment market size was reportedly valued at $1.95 billion and is positively forecasted to reach this level again in 2023 during the phase of post-pandemic.

by Nora Ismail and Goh Pearl Lyn

The Reality …

Even before the COVID-19 global pandemic hit, the recreational scuba diving equipment was charting a steady “downward-dog” decline of an average of -4.6% annually over the last 5 years. Based on the final report by the Sports and Fitness Industry Association (SFIA), the sales on dive gears in 2020 suffered a drop of 20% at wholesale and it is probable that 20% of retail dive shops would probably cease due to the impact by the pandemic as reported by the Business of Diving Institute (BODI).

All the same, in the recent annual evaluation study on the size of the scuba diving industry by BODI, the scuba diving equipment market at $1.95 billion, in 2019, at retail value to scuba diving consumers.

The Predicament: Scuba Diving Industry vs Global Travel Industry

The growth of success for the scuba diving industry is highly dependent on the global dive travel market. As the world travellers face the conundrum with the border lockdown and the hassle with the various pre-travel requirements, and not forgetting the added economical burden on serving “quarantine” and the COVID-19 health checks obligations on one’s financial account, one could only hope when will the industry will bounce back on track after the pandemic to have a direct impact on dive gear sales worldwide.

Oxford Economics forecasted and predicted that “international tourism won’t reach 2019 levels again until 2024”. In November 2020, the USA Travel Association (USTA) forecasted a 37.5% increase in travel spending in 2021, followed by a 14.2% increase in 2022. But it won’t be until a predicted 7.4% increase in 2023 that the travel industry can consider a recovery scenario to a full actualisation.

Micro into the Upwardly Curve

“Evaluated at $1.95 billion in 2019, the global recreational scuba diving equipment market size is forecasted to reach this level again in 2023”

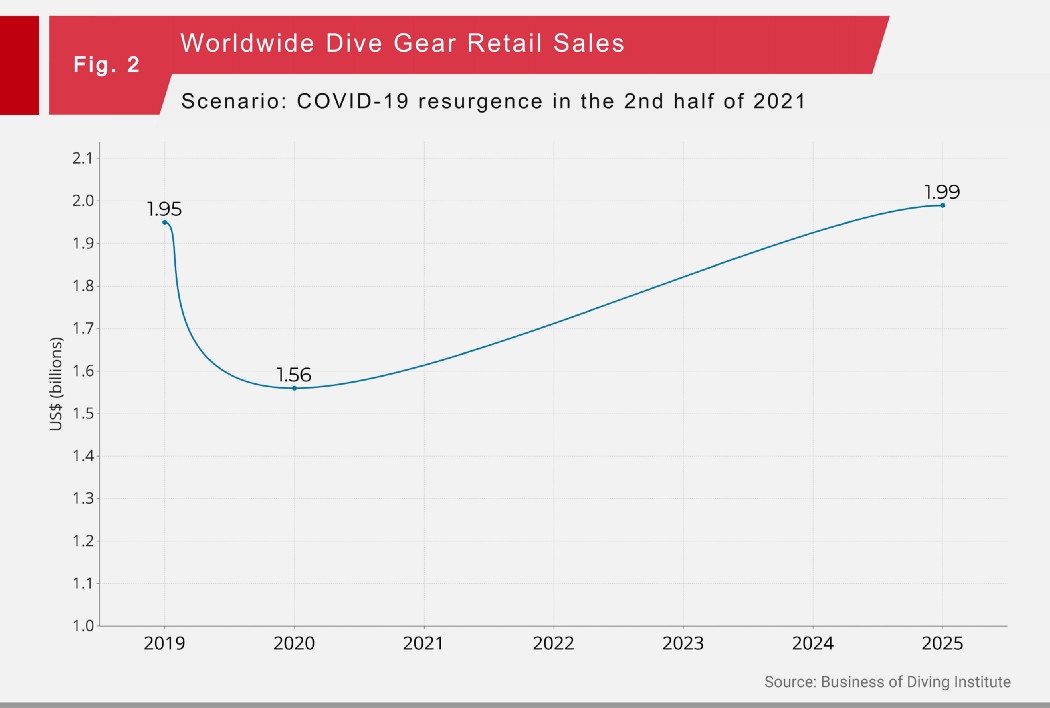

A new wave of travel restrictions due to a resurgence of COVID-19 fuelled by variants could possibly defer the dates for full recovery of the worldwide scuba diving equipment sales to 2024 or 2025? Or, would countries brazenly push boundaries for economic stability by exercising various contingency models towards the phase of endemic?

Worldwide Dive Gear Retail Sales Forecast— Scenario: COVID-19 Under Control in 2021

Worldwide Dive Gear Retail Sales Forecast — Scenario: COVID-19 Resurgence in 2021

The global diving equipment market is classified into speciality stores, big-box retailers, and online. Traditionally, speciality stores have been the leading suppliers of dive gear in what is a niche market.

Post-pandemic, online retailing will pick up a significant part of market shares to compensate for the closure of local dive shops.

“Well-established dive speciality retailers that weathered the pandemic will also increase their market shares.”

The key dive gear product segments are:

- Scuba Unit

- Fins, Masks, Snorkels

- Dive Suits

- Non-Essentials

Scuba diving equipment in the “scuba unit” segment includes:

- BCDs (vests)

- Regulators

- Computers & Gauges

- Rebreathers

Dive gear in the “non-essential” segment includes:

- Photo & Video Equipment

- Bags & Luggage

- Apparel

- Dive Accessories

Some scuba diving equipment product segments will rebound faster and better than others, considering the pre-pandemic trend toward travelling light and a relative increase in scuba diving participation by casual divers.

The three scuba diving equipment segments expected to grow exponentially than the rest of the dive gear market are:

- Computers

- Dive Suits

- Accessories

The Imminent Future in the Phase of Endemic

The boom in scuba diving derives from significant collective investments in the various product segments – from retail to education and dives, the emergence and growth in the number of scuba diving schools, scuba diving equipment shops, and scuba diving charter businesses.

Herewith, the most obvious question for any business to emerge through the noise during looming and uncertain times, and future, what should a dive business do to remain relevant in the awakening era of new normal?

Here are some ways:

-

- Step Back, Focus Inward and Reverberate StrategicallyAdjusting to a “new normal” is never an easy task. With an uncertain future and tangible business plans and KPIs as a business endures the unknown, the best way a business could adapt and thrive is to step back, focus inward and review your existing services, products, methods, facilities and processes. Explore and experiment various approaches, albeit traditional media and new media, and strategically align your business focuses to the best channel to remain prominent in the market.

- Go Digitally Strong and Make Reality in the Hybrid platform

KPIs are important – In finding an effective way of measuring your brand’s success and mapping your investment’s journey, going digitally strong and exploring a hybrid platform keeps your brand retention in the market sustainably.

By adapting to the present digital–hybrid–marketing landscape with a strategic brand or product proposition through tactical and creative approaches, a measurable return of investments are justified and you would gain an insightful look to your brand’s journey and the dive market for further business analytic perusal.

-

- Rethinking your Marketing Investments

Dive fearlessly into investing in new media through the following ways.

The importance of teamwork

Scuba-diving depends on the core of teamwork. So do any businesses. With scuba, there’s the buddy you dive with and the person in the boat who you rely on to be there when you come to the surface. Confidence and trust in teamwork is imminent to the success of a dive and that lesson can be taken into business too. The strongest teams are those that really trust each other, seek the right partner in crime.Good pressure to get into the winning mindset

Similar to diving on a reef, we get to explore and investigate complicated products and businesses together with their challenging objectives. Identifying each microcosm of commerce in its own right with a good level of pressure to get it right. The key takeaway here is on constant challenges and picking on opportunities to keep the execution fresh!Running out of air? Focus on the real objective

If you enjoy diving. You need to get a buzz from the experience of exploring and seeing things with your own eyes. Otherwise, it’s just not worth doing. There are a select few that don’t like diving as they find it scary. And when you’re stressed, you run out of air much more quickly. An air tank might last a calm diver for an hour while someone who can’t relax will use up the same-sized tank in 10 minutes. Same applies to business!

- Rethinking your Marketing Investments

Sourced research from Scubanomics and the Business of Diving Institute (BODI)

Underwater360º is dedicated to all things dive-related. We feature a balance of creative solutions designed to work together easily – from print and audio to virtual, as well as hybrid solutions.

Discover our platform featuring a curation of channels including our compelling Diveaholic magazines, podcasts and monthly ADEX Pixel Webinars with remarkable figures, and our brand-new hybrid October’s Bazaar — the world’s first virtual exhibition! Not forgetting, get your daily digest of diving stories and articles on uw360.asia.

We’d love to get to know you better. Talk to us at hello@uw360.asia.